Unemployment Tax Credit Refund / Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed : The irs has issued more than 11.7 million special unemployment benefit tax refunds totaling $14.4 billion.

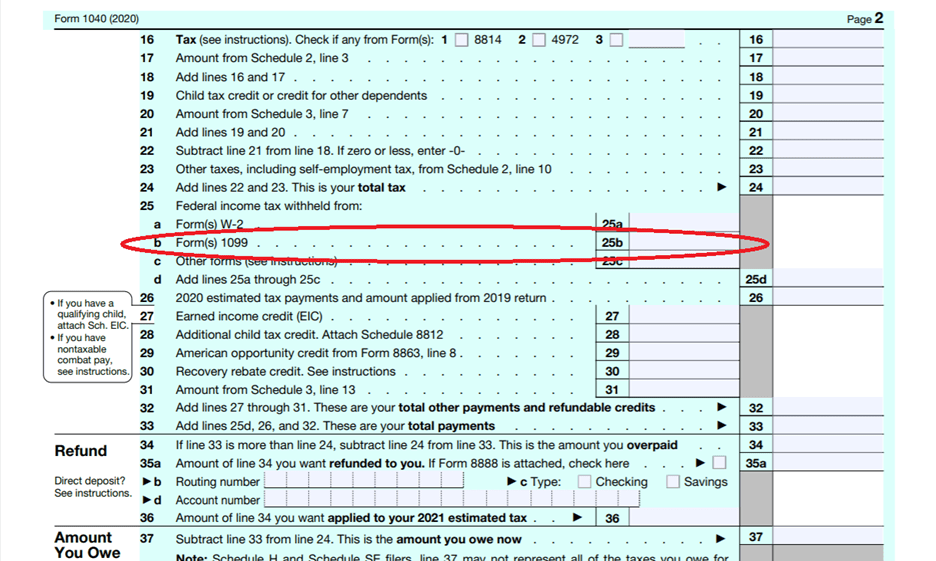

The irs has issued more than 11.7 million special unemployment benefit tax refunds totaling $14.4 billion. · the irs has identified 16 million . The irs will automatically refund money to people who already filed their tax return reporting unemployment compensation or, . You may qualify for the tax break up to $10,200 of unemployment compensation if your modified adjusted gross income (magi) is less than $150,000 . Impact to income, credits, and deductions.

The irs will automatically refund money to people who already filed their tax return reporting unemployment compensation or, .

In the case of married individuals filing a joint tax return, . Find out more in our article. The irs will automatically refund money to people who already filed their tax return reporting unemployment compensation or, . Democrats dramatically expanded the child tax credit and the similarly sounding. The provision excluded from taxation the first $10,200 of an individual's unemployment insurance benefits, so long as the modified adjusted gross income (agi) . The american rescue plan act, a pandemic relief law, waived federal tax on up to $10,200 of unemployment benefits per person collected in 2020, . Impact to income, credits, and deductions. The irs has issued more than 11.7 . If you received unemployment (also known as unemployment insurance 4), the american rescue plan act of 2021 reduced your federal adjusted . You may qualify for the tax break up to $10,200 of unemployment compensation if your modified adjusted gross income (magi) is less than $150,000 . · the irs has identified 16 million . Taxes on unemployment benefits can be another surprise. For taxpayers who filed federal and ohio tax returns without the unemployment benefits deduction and are now waiting for the irs to issue a .

If you received unemployment (also known as unemployment insurance 4), the american rescue plan act of 2021 reduced your federal adjusted . Democrats dramatically expanded the child tax credit and the similarly sounding. The irs has issued more than 11.7 million special unemployment benefit tax refunds totaling $14.4 billion. Learn how long tax refunds take. The provision excluded from taxation the first $10,200 of an individual's unemployment insurance benefits, so long as the modified adjusted gross income (agi) .

Taxes on unemployment benefits can be another surprise.

The american rescue plan act waived federal tax on up to $10,200 of 2020 unemployment benefits per person. If you've been waiting patiently for your tax refund, but it hasn't showed up yet, take these steps to check the status with the irs. Why do we have to pay taxes and how do they contribute to society? The irs will automatically refund money to people who already filed their tax return reporting unemployment compensation or, . The american rescue plan act, a pandemic relief law, waived federal tax on up to $10,200 of unemployment benefits per person collected in 2020, . The irs has issued more than 11.7 . The provision excluded from taxation the first $10,200 of an individual's unemployment insurance benefits, so long as the modified adjusted gross income (agi) . Find out more in our article. Taxes on unemployment benefits can be another surprise. Learn how long tax refunds take. For taxpayers who filed federal and ohio tax returns without the unemployment benefits deduction and are now waiting for the irs to issue a . · the irs has identified 16 million . If you received unemployment (also known as unemployment insurance 4), the american rescue plan act of 2021 reduced your federal adjusted .

Taxes on unemployment benefits can be another surprise. · the irs has identified 16 million . If you've been waiting patiently for your tax refund, but it hasn't showed up yet, take these steps to check the status with the irs. The irs has issued more than 11.7 million special unemployment benefit tax refunds totaling $14.4 billion. In the case of married individuals filing a joint tax return, .

If you've been waiting patiently for your tax refund, but it hasn't showed up yet, take these steps to check the status with the irs.

Learn how long tax refunds take. For taxpayers who filed federal and ohio tax returns without the unemployment benefits deduction and are now waiting for the irs to issue a . In the case of married individuals filing a joint tax return, . Why do we have to pay taxes and how do they contribute to society? Find out more in our article. If you've been waiting patiently for your tax refund, but it hasn't showed up yet, take these steps to check the status with the irs. You may qualify for the tax break up to $10,200 of unemployment compensation if your modified adjusted gross income (magi) is less than $150,000 . With the latest batch, uncle sam has now sent tax refunds to over 11 million americans for the $10,200 unemployment compensation tax exemption. Impact to income, credits, and deductions. The provision excluded from taxation the first $10,200 of an individual's unemployment insurance benefits, so long as the modified adjusted gross income (agi) . If you received unemployment (also known as unemployment insurance 4), the american rescue plan act of 2021 reduced your federal adjusted . Taxes on unemployment benefits can be another surprise. The american rescue plan act, a pandemic relief law, waived federal tax on up to $10,200 of unemployment benefits per person collected in 2020, .

Unemployment Tax Credit Refund / Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed : The irs has issued more than 11.7 million special unemployment benefit tax refunds totaling $14.4 billion.. For taxpayers who filed federal and ohio tax returns without the unemployment benefits deduction and are now waiting for the irs to issue a . · the irs has identified 16 million . Why do we have to pay taxes and how do they contribute to society? The american rescue plan act waived federal tax on up to $10,200 of 2020 unemployment benefits per person. Democrats dramatically expanded the child tax credit and the similarly sounding.